Managing Your Portfolio from Your 20s to 50s: An Expert Guide for Indian Investors

Managing Your Portfolio from Your 20s to 50s: An Expert Guide for Indian Investors

Managing Your Portfolio from Your 20s to 50s: An Expert Guide for Indian Investors

Feb 23, 2025

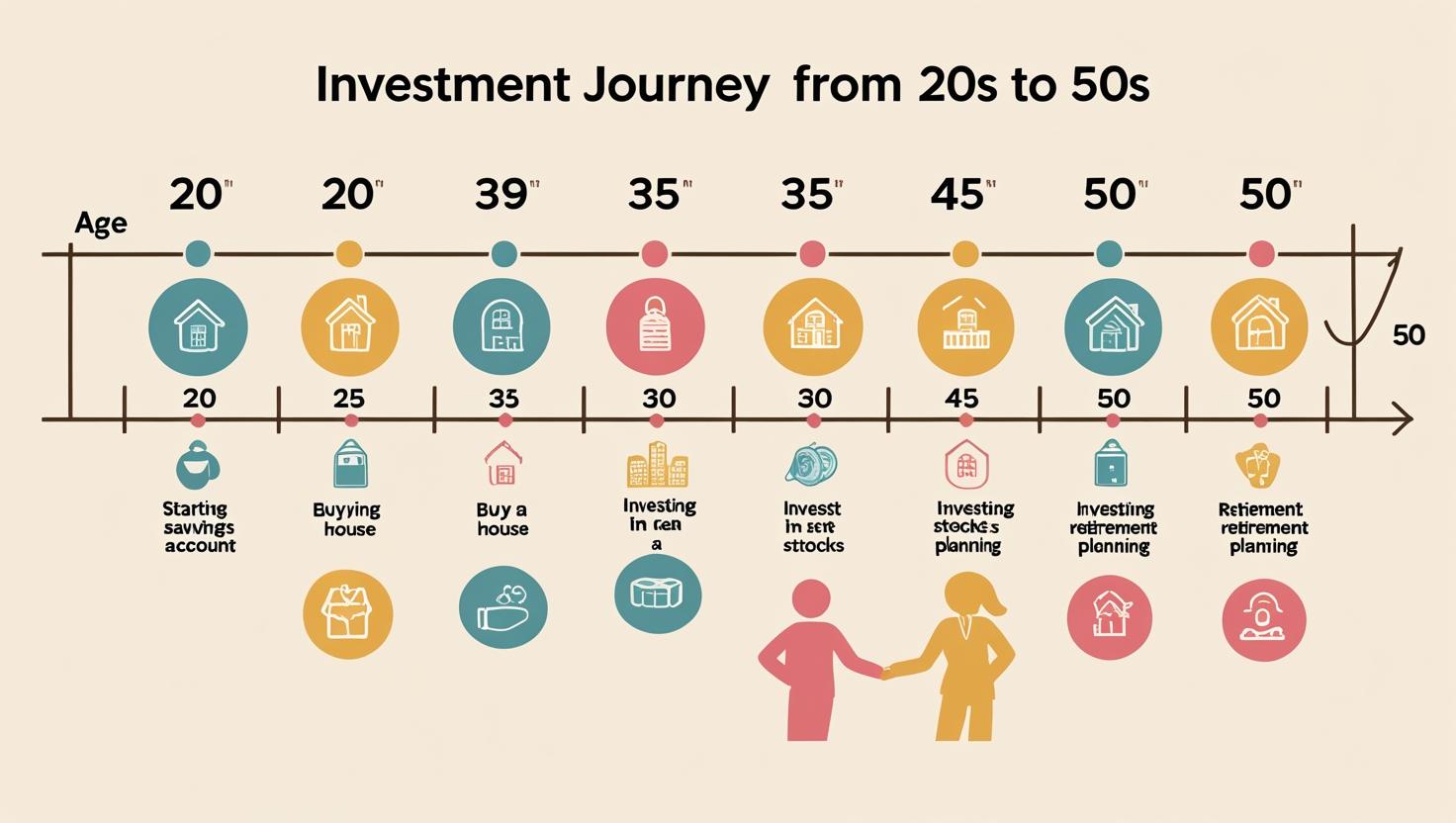

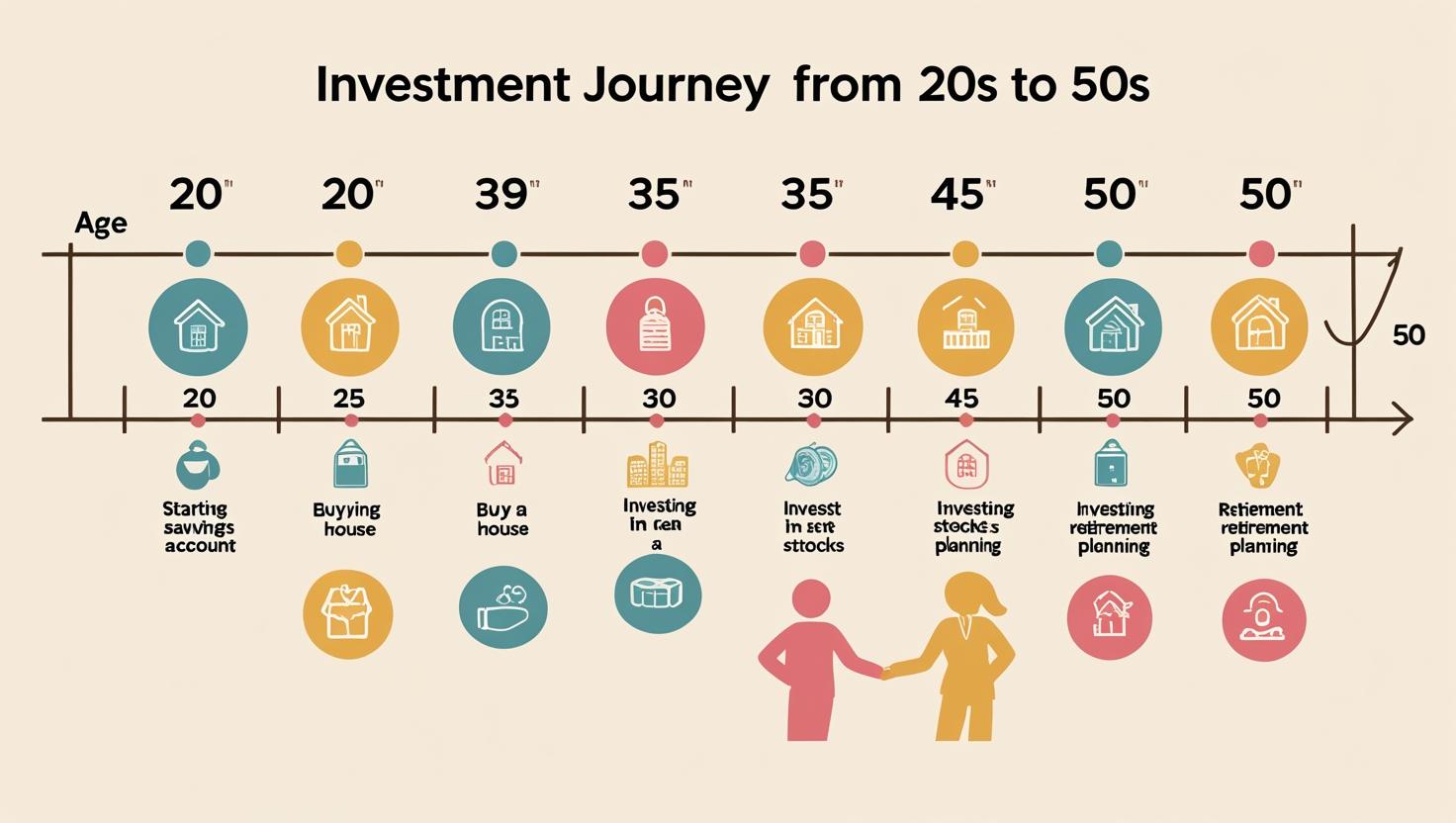

Introduction: Your investment journey is not a sprint; it's a marathon. Just as your life goals, income, and responsibilities change over time, so should your investment portfolio. A "one-size-fits-all" approach simply doesn't work. This expert guide provides a strategic roadmap for Indian investors on managing your portfolio from your 20s to 50s, aligning your investments with your evolving life stages and financial goals.

The Golden Rule: Asset Allocation by Age Asset allocation – dividing your investment portfolio among different asset categories like equities, debt, gold, and real estate – is the most critical decision you'll make. The conventional "100 minus age" rule (e.g., at 30, 70% in equity) is a starting point, but a personalized approach considering financial goals, dependents, and investment horizon is crucial for effective asset allocation [Source: Economic Times, May 2025].

Introduction: Your investment journey is not a sprint; it's a marathon. Just as your life goals, income, and responsibilities change over time, so should your investment portfolio. A "one-size-fits-all" approach simply doesn't work. This expert guide provides a strategic roadmap for Indian investors on managing your portfolio from your 20s to 50s, aligning your investments with your evolving life stages and financial goals.

The Golden Rule: Asset Allocation by Age Asset allocation – dividing your investment portfolio among different asset categories like equities, debt, gold, and real estate – is the most critical decision you'll make. The conventional "100 minus age" rule (e.g., at 30, 70% in equity) is a starting point, but a personalized approach considering financial goals, dependents, and investment horizon is crucial for effective asset allocation [Source: Economic Times, May 2025].

The conventional "100 minus age" rule (e.g., at 30, 70% in equity) is a starting point, but a personalised approach considering financial goals, dependents, and investment horizon is crucial for effective asset allocation.

Your Portfolio Through the Decades:

20s: The Growth Decade (Aggressive)

Focus: Wealth accumulation, high growth.

Risk Appetite: High. You have a long investment horizon to recover from market downturns.

Goals: Building an emergency fund (6-12 months expenses), investing for first big goals (car, higher education, marriage), starting retirement savings.

Asset Allocation:

Equity (70-80%): Large-cap, mid-cap, and potentially small-cap funds via SIPs. Direct equities for informed investors.

Debt (10-20%): FDs, liquid funds for emergency fund.

Gold (5-10%): Small allocation for diversification.

Actionable: Start SIPs early to harness the power of compounding. Don't be afraid of market volatility; it's your friend for long-term growth.

30s: The Family & Career Growth Decade (Moderately Aggressive)

Focus: Balancing growth with increased responsibilities.

Risk Appetite: Moderate to High. Income likely increasing, but new financial commitments (home loan, child's education) emerge.

Goals: Home down payment, child's education fund, expanding retirement corpus.

Asset Allocation:

Equity (60-70%): Continue equity exposure, leaning towards large & mid-cap for stability.

Debt (20-30%): Increase debt allocation for stability, consider good quality bonds.

Gold/Real Estate (10%): Consistent small allocation.

Actionable: Review and rebalance your portfolio annually. Increase SIP contributions with income growth. Consider term insurance and health insurance.

40s: The Peak Earning & Consolidation Decade (Moderately Conservative)

Focus: Consolidating wealth, accelerating retirement savings.

Risk Appetite: Moderate. Fewer years to retirement, so capital preservation becomes more important.

Goals: Maxing out retirement contributions, planning for children's higher education/marriage, wealth transfer planning.

Asset Allocation:

Equity (50-60%): Gradual shift towards large-cap and diversified equity funds.

Debt (30-40%): Increase debt portion, including corporate bonds, G-Secs, and PPF.

Gold/Real Estate (5-10%): Maintain.

Actionable: Prioritize debt reduction. Begin a comprehensive retirement plan. Consider Estate Planning.

50s: Pre-Retirement & Preservation Decade (Conservative)

Focus: Capital preservation and generating stable income for retirement.

Risk Appetite: Low to Moderate. Protecting accumulated wealth is paramount.

Goals: Transitioning to income-generating assets, final retirement planning.

Asset Allocation:

Equity (30-40%): Largely in stable, dividend-paying large-cap stocks/funds.

Debt (50-60%): High allocation to FDs, SCSS, G-Secs, debt mutual funds.

Gold/Real Estate (10-15%): For diversification and inflation hedge.

Actionable: Shift from growth-oriented to income-oriented investments. Create a retirement income plan.

Your Portfolio Through the Decades:

20s: The Growth Decade (Aggressive)

Focus: Wealth accumulation, high growth.

Risk Appetite: High. You have a long investment horizon to recover from market downturns.

Goals: Building an emergency fund (6-12 months expenses), investing for first big goals (car, higher education, marriage), starting retirement savings.

Asset Allocation:

Equity (70-80%): Large-cap, mid-cap, and potentially small-cap funds via SIPs. Direct equities for informed investors.

Debt (10-20%): FDs, liquid funds for emergency fund.

Gold (5-10%): Small allocation for diversification.

Actionable: Start SIPs early to harness the power of compounding. Don't be afraid of market volatility; it's your friend for long-term growth.

30s: The Family & Career Growth Decade (Moderately Aggressive)

Focus: Balancing growth with increased responsibilities.

Risk Appetite: Moderate to High. Income likely increasing, but new financial commitments (home loan, child's education) emerge.

Goals: Home down payment, child's education fund, expanding retirement corpus.

Asset Allocation:

Equity (60-70%): Continue equity exposure, leaning towards large & mid-cap for stability.

Debt (20-30%): Increase debt allocation for stability, consider good quality bonds.

Gold/Real Estate (10%): Consistent small allocation.

Actionable: Review and rebalance your portfolio annually. Increase SIP contributions with income growth. Consider term insurance and health insurance.

40s: The Peak Earning & Consolidation Decade (Moderately Conservative)

Focus: Consolidating wealth, accelerating retirement savings.

Risk Appetite: Moderate. Fewer years to retirement, so capital preservation becomes more important.

Goals: Maxing out retirement contributions, planning for children's higher education/marriage, wealth transfer planning.

Asset Allocation:

Equity (50-60%): Gradual shift towards large-cap and diversified equity funds.

Debt (30-40%): Increase debt portion, including corporate bonds, G-Secs, and PPF.

Gold/Real Estate (5-10%): Maintain.

Actionable: Prioritize debt reduction. Begin a comprehensive retirement plan. Consider Estate Planning.

50s: Pre-Retirement & Preservation Decade (Conservative)

Focus: Capital preservation and generating stable income for retirement.

Risk Appetite: Low to Moderate. Protecting accumulated wealth is paramount.

Goals: Transitioning to income-generating assets, final retirement planning.

Asset Allocation:

Equity (30-40%): Largely in stable, dividend-paying large-cap stocks/funds.

Debt (50-60%): High allocation to FDs, SCSS, G-Secs, debt mutual funds.

Gold/Real Estate (10-15%): For diversification and inflation hedge.

Actionable: Shift from growth-oriented to income-oriented investments. Create a retirement income plan.

For latest in market updates check out our newsletter - AMPLIFY.

Key Takeaway: Your portfolio should be a living, breathing entity that adapts to your life. Regular review and rebalancing are essential. For complex portfolio management and personalized asset allocation that leverages data-driven insights, a Quant-based PMS can provide an expert-guided, systematic approach through all your life stages.

Key Takeaway: Your portfolio should be a living, breathing entity that adapts to your life. Regular review and rebalancing are essential. For complex portfolio management and personalized asset allocation that leverages data-driven insights, a Quant-based PMS can provide an expert-guided, systematic approach through all your life stages.

Know more by booking a discovery call with our team

Know more by booking a discovery call with our team